US宏观

…

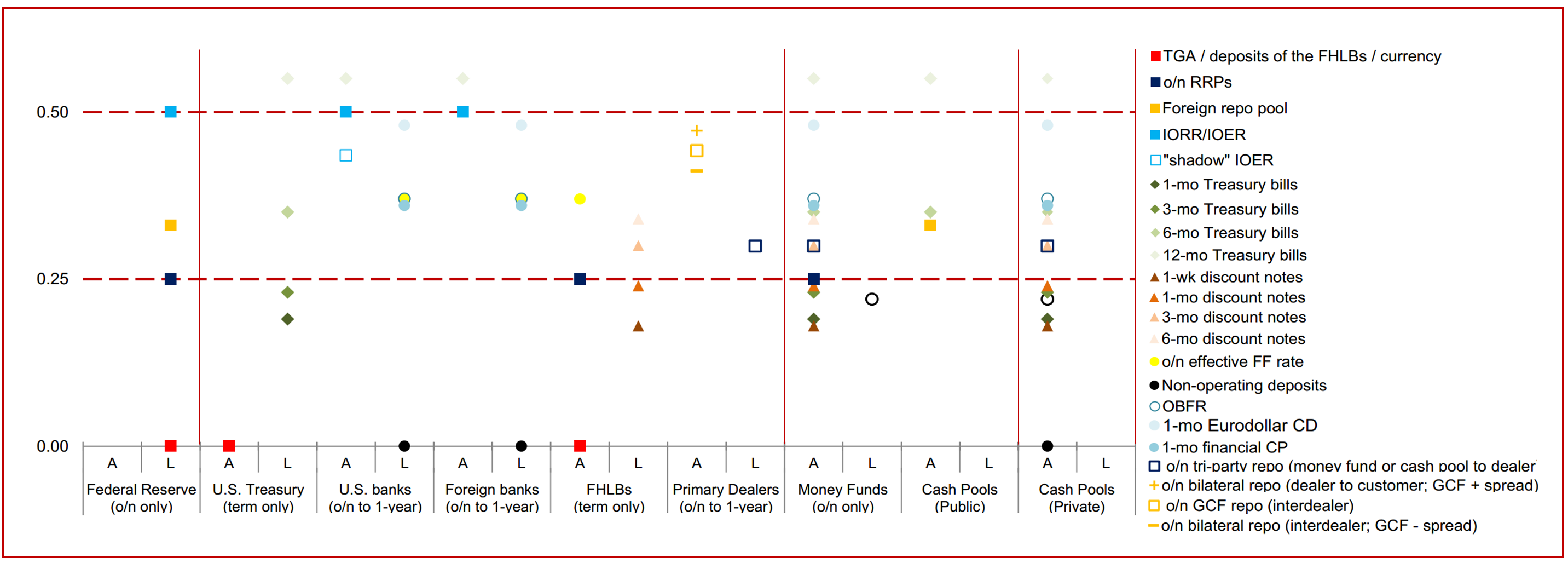

Money Markets after QE and Basel III (2016)

Money Market共有3类(9个)参与者

- The money authority (the federal reserve)

- The group of money dealers (Treasury, the FHLBs, banks, primary dealers and money funds)

- The group of cash pools

- public: liquidity tranche of FX reserves and the cash pools of multilateral organizations such as IMF

- private: cash balances of corporations, asset managers and hedge funds.

Fed (o/n only)

- Liability side (o/n only)

- TGA/deposits of the FHLBs/currency, pay 0

- o/n RRPs pay, 0.25

- foreign repo pools, pay more than o/n RRP

- reserves, IORR/IOER, pay 0.50

- Asset side

- SOMA, earn around 2.65%

U.S. Treasury (term only)

- Liability side

- 1, 3, 6, 12-month treasury bills

- Asset side

- TGA deposit, earn 0

U.S. banks (o/n to 1-year)

- Liability side

- fed funds, pay o/n effective FF

- non-operating deposits, pay 0

- commercial paper(CP)

- Asset side

- reserves, earn IORR/IOER

- reserves, earn shadow IOER due to surcharge to the FDIC

- 12-month treasury bills

Foreign banks (o/n to 1-year)

- Liability side

- fed funds, pay o/n effective FF

- non-operating deposits, pay 0

- commercial paper(CP)

- Asset side

- reserves, earn IORR/IOER

- 12-month treasury bills

FHLBs (term only)

- Liability side

- 1 week 1, 3, 6-month discount notes(discos)

- Asset side

- deposits in Fed, earn 0

- o/n RRPs, earn 0.25

- fed funds, earn o/n effective FF (额外的流动性在fed funds market上出借)

Primary Dealers (o/n to 1-year)

- Liability side

- o/n tri-party repo

- Asset side

- Lend to other primary dealers or non-primary dealers, earn o/n GCF repo & +- spread

Money Funds (o/n only)

- Liability side

- MMF shares(some index)

- Asset side

- o/n RRPs, earn 0.25

- 1, 3-month treasury bills (有access to更高收益的o/n RRPs, 但是一般资金是下午3:30后返还,为保持日内流动性,也会放弃部分收益持有1, 3-month bills)

- 6-month treasury bills

- 12-month treasury bills

- 1 week 1, 3, 6-month discount notes(discos)

- commercial paper(CP)

- o/n tri-party repo

Cash Pools(public)

- Liability side

- Asset side

- foreign repo pool, earn more than o/n RRPs

- 6-month treasury bills (只有当收益超过foreign repo pool时才会考虑)

- 12-month treasury bills

Cash Pools(private)

- Liability side

- Non-operating deposits, earn 0

- Asset side

- 1, 3-month treasury bills

- 6-month treasury bills

- 12-month treasury bills

- 1 week 1, 3, 6-month discount notes(discos)

- commercial paper(CP)

- o/n tri-party repo

- MMF shares(some index)

The Hierarchy of Money

- o/n RRPs are a hard floor under o/n tri-party treasury repo rate (primary dealers’ core funding rate)

- o/n tri-party treasury repo rate is generally below o/n unsecured bank funding rates

- o/n GCF treasury repo rate (primary dealers’ core lending rate) is generally above unsecured bank funding rates

- IOER rate is a soft ceiling for the o/n GCF treasury repo rate

US 金融数据

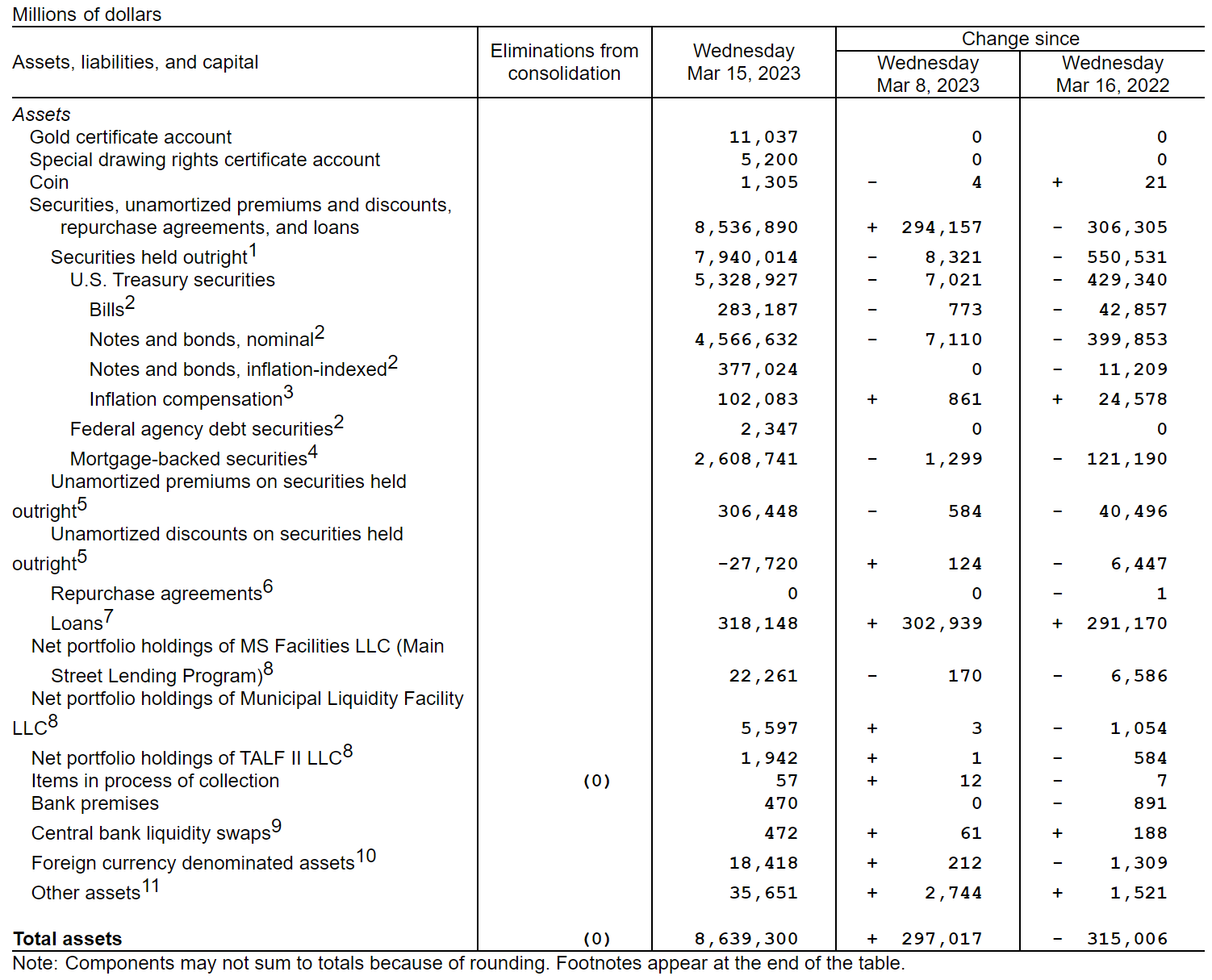

最新已经8.6393万亿

H.4.1

资产端:

- Securiities held outright,目前占92%

- Loans, 最新因为BTFP多增了119亿美元

负债端: - Federal Reserve notes流通中的现金

- 逆回购协议,这次下降了1372亿,释放了流动性

- 存款性机构其他存款(准备金)这次增长了4405亿

表一更加详细

H8 Commercial Banks的信贷

资产端

- 信贷

- Securities

- Treasury and agency serurities

- MBS

- Non-MBS

- Other securities 不被US.gov担保的

- MBS

- Non-MBS

- Treasury and agency serurities

- Loans and leases in bank credit

- Commericial and Industrial loans

- Real estate loans

- Revolving home equity loans 求偿权在第二顺位

- Closed-end residential loans

- Commercial real estate loans

- Construction and land development loans

- Secured by farmland

- Secured by multifamily properties

- Secured by nofarm nonresidential properties

- Consumer loans

- Credit cards and other revolving plans

- Other consumer loans

- Automobile loans

- All other consumer loans

- All other loans and leases

- Loans to nondepository financial institutions

- All loans not elsewhere classified

- Securities

- Less Allowance for loan and lease

- Cash

- Total federal funds sold and reserve RPs

- Loans to commercial banks

- Other assets including trading assets

商票

参考国内的流程

国内表内票据融资用来调节信贷规模,当实体经济信贷需求弱时,银行风险偏好低,银行通过票据贴现,扩充信贷规模;当信贷额度紧张时,再转贴现出去。新增票据融资和贷款需求指数通常呈现负相关。表外票据融资对经济景气度具有明显的正相关。

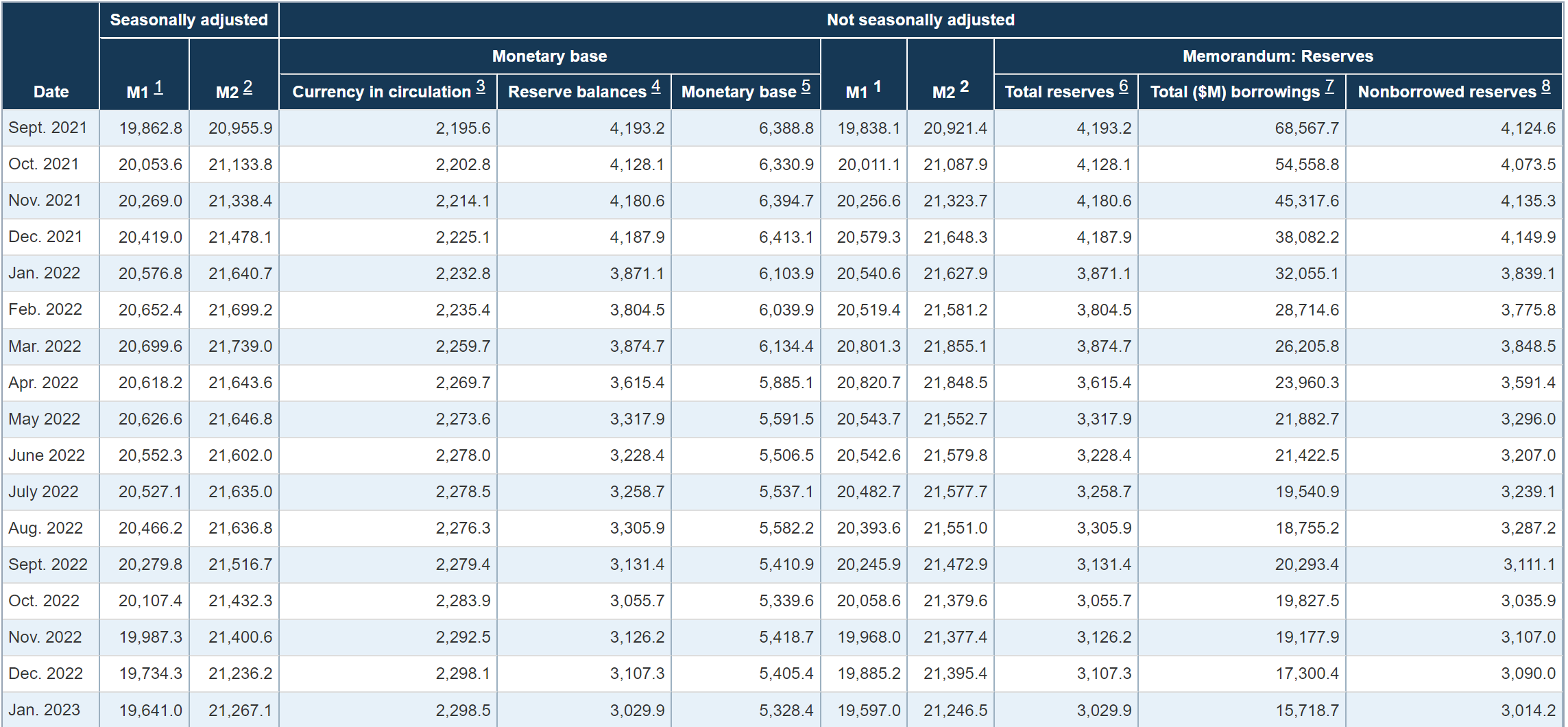

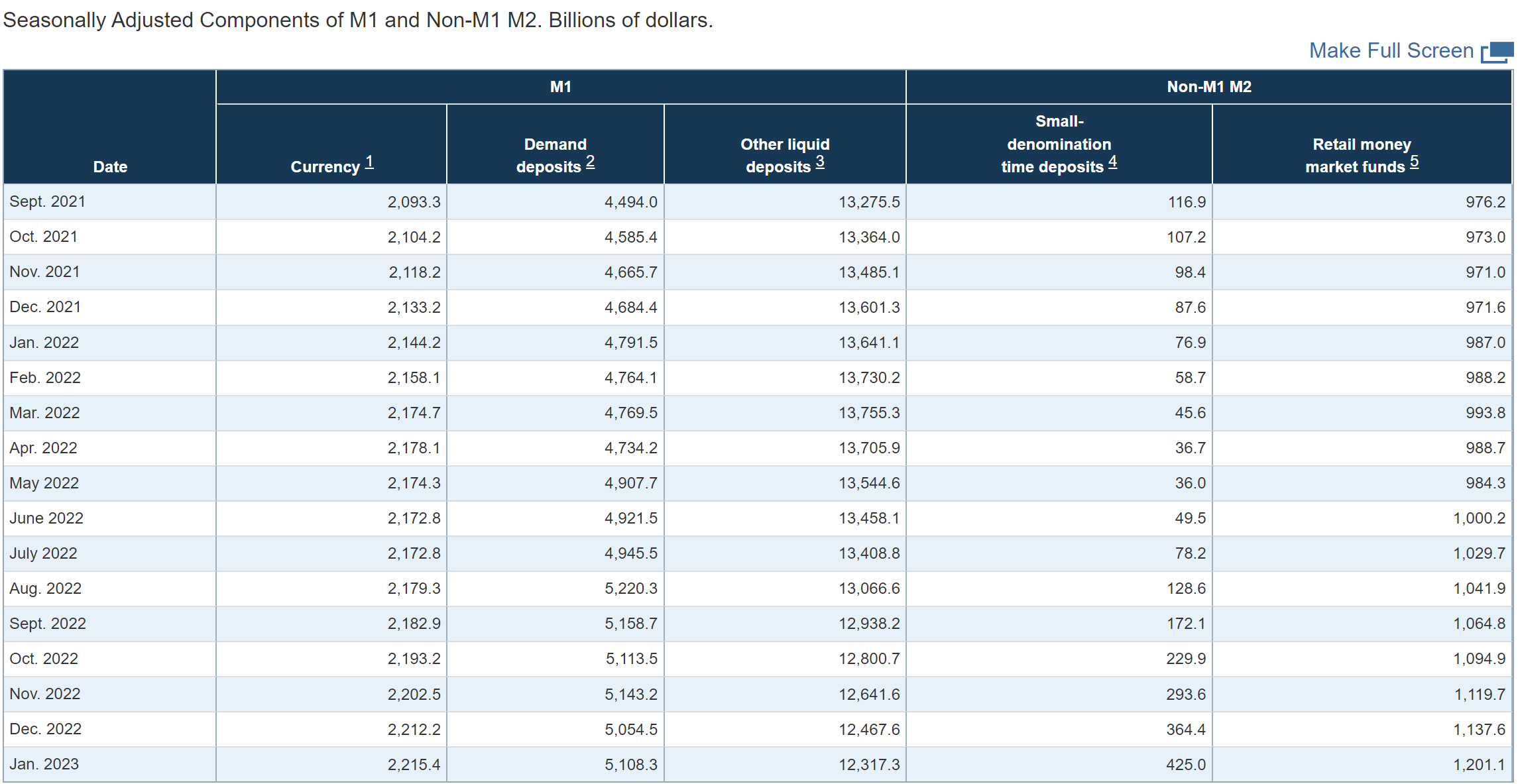

H.6 货币余额

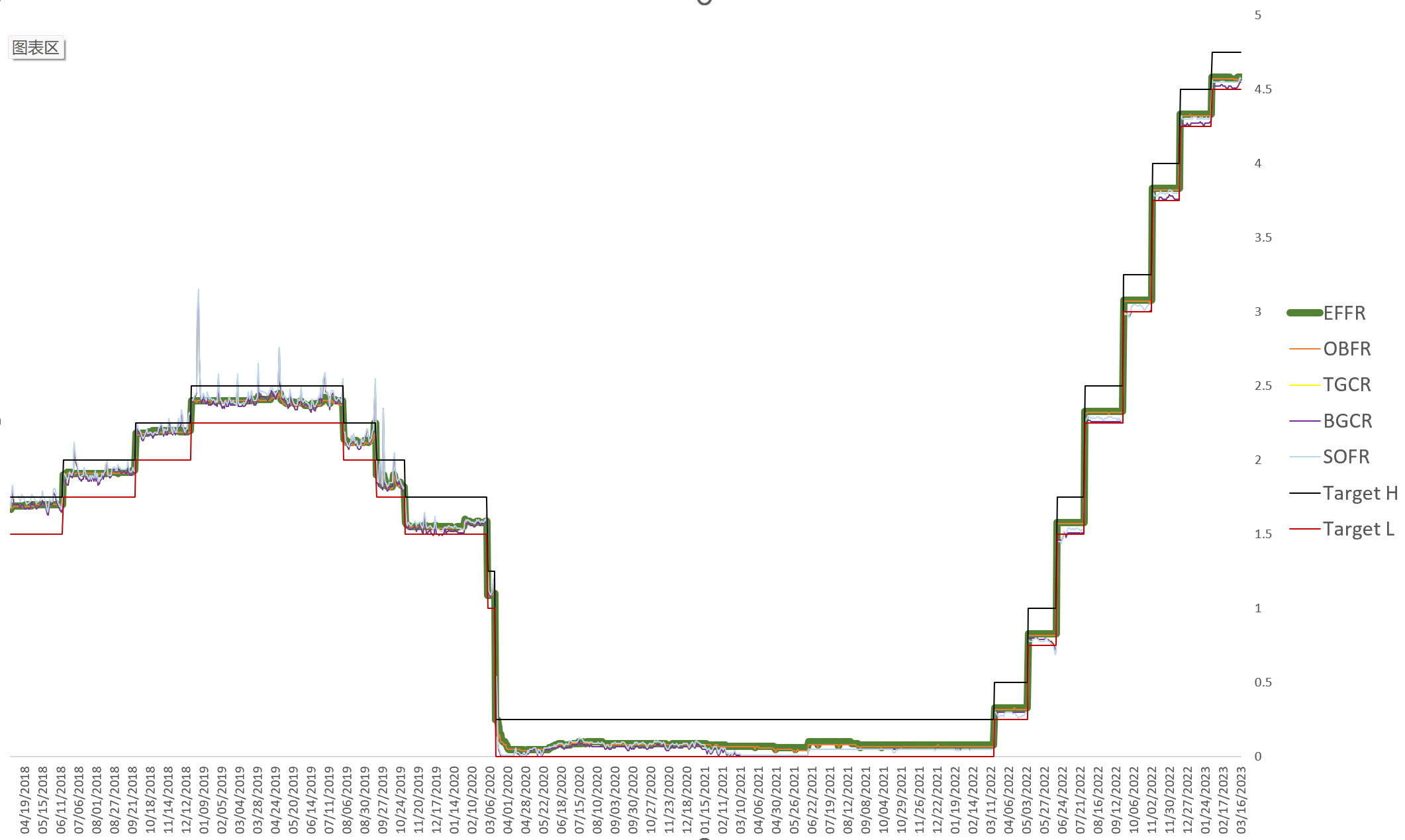

(2019.9.17 5.25%这里删掉了)

- OBER 一行隔夜拆款利率

- SOFR 有担保的隔夜融资利率 替代LIBOR

- BGCR 一般附担保品利率

- TGCR 三方附担保品利率

- Discount Window

Reference:

- Global Money Notes 1-31. Zoltan Pozsar

- How the Financial System Works - A map of Money Flows in the Global Financial Ecosystem. Zoltan Pozsar

- Money Market after QE and Basel III. Zoltan Pozar

- Shadow Banking: The Money View. Zoltan Pozar

- The Research Handbook of Financial Markets Conference.